On the 24th of October 2023, the Malaysian Ringgit slumped to record lows against the Singapore Dollar. 1 Singapore Dollar would yield 3.5 Malaysian Ringgit.

This was not the first time this rate we had seen such an exchange rate against the ringgit. The same rate occurred on 12th July 2023.

The weak ringgit has resulted in an outflow of workers from Malaysia into Singapore. Workers in Malaysia are finding it more attractive to work overseas and earn foreign currency like Singapore Dollars to bring back to Malaysia. This is not the ideal situation for Malaysia as this will result in a brain drain from the economy.

Malaysians and Malaysian businesses would find imports and debts that are serviced in foreign currencies more expensive due to the depreciation of the ringgit. On the flip side, the weaker ringgit will make Malaysian exports cheaper which could eventually help to boost Malaysia’s current account balance. This positively affects Malay’s gross domestic product.

The weak ringgit is a result of the high level of uncertainty in the country. This is even more pronounced when it is next to Singapore which is typically seen as a beacon of stability in terms of politics and policies. The political uncertainty within Malaysia especially with the high-level corruption cases has caused investors to look at Malaysia less favourably.

One example where this would be evident would be investors’ view of government-issued debt like government bonds. Debt is issued in the currency where it is issued. Singapore government bonds are issued in Singapore dollars. Hence investors would have to pay for such debt in Singapore dollars with an expectation that the Singapore dollar would either remain stable or increase in value against their home currency. For example, if an investor were to purchase a Singapore government bond for SGD$1 million with a coupon payment of 4% per annum, he would have to fork out SGD$1 million and if the bond matures at the end of the one-year period, he would have SGD$1,040,000. If that investor were Malaysian, he would not only enjoy this increase of SGD$40,000 on top of his initial SGD$1 million but he would also enjoy an additional increase in the value of the Singapore Dollar against the Malaysian Ringgit when he converts his SGD$1,040,000 back to Malaysian Ringgit.

Now imagine the flipside of this.

if an investor were to purchase a Malaysian government bond for MYR$1 million with a coupon payment of 4% per annum, he would have to fork out MYR$1 million and if the bond matures at the end of the one-year period, he would have MYR$1,040,000. If that investor were Singaporean, he would enjoy this increase of MYR$40,000 on top of his initial MYR$1 million but he would also suffer the decrease in the value of the Malaysian Ringgit against the Singapore Dollar when he converts his MYR$1,040,000 back to Singapore Dollar.

The constant weakening of the Malaysian Ringgit is not helping as foreign investors will find Malaysia less attractive from an investment standpoint. No matter which country you are living in, the rest of the world is bigger than your country. Hence, remaining attractive to foreigners is always important. Hopefully, Malaysia can see a more prolonged period of political stability which will translate to a better economy. This will be down to the current government to instil policies which will have long-term benefits to the country.

On a more casual note…

Malaysia is looking like a very attractive place for Singaporeans to patronise!

Shopping, dining and leisure.

We at Little Big Red Dot have realised that there is no structured guide to shopping, dining and leisure in Johor Bahru.

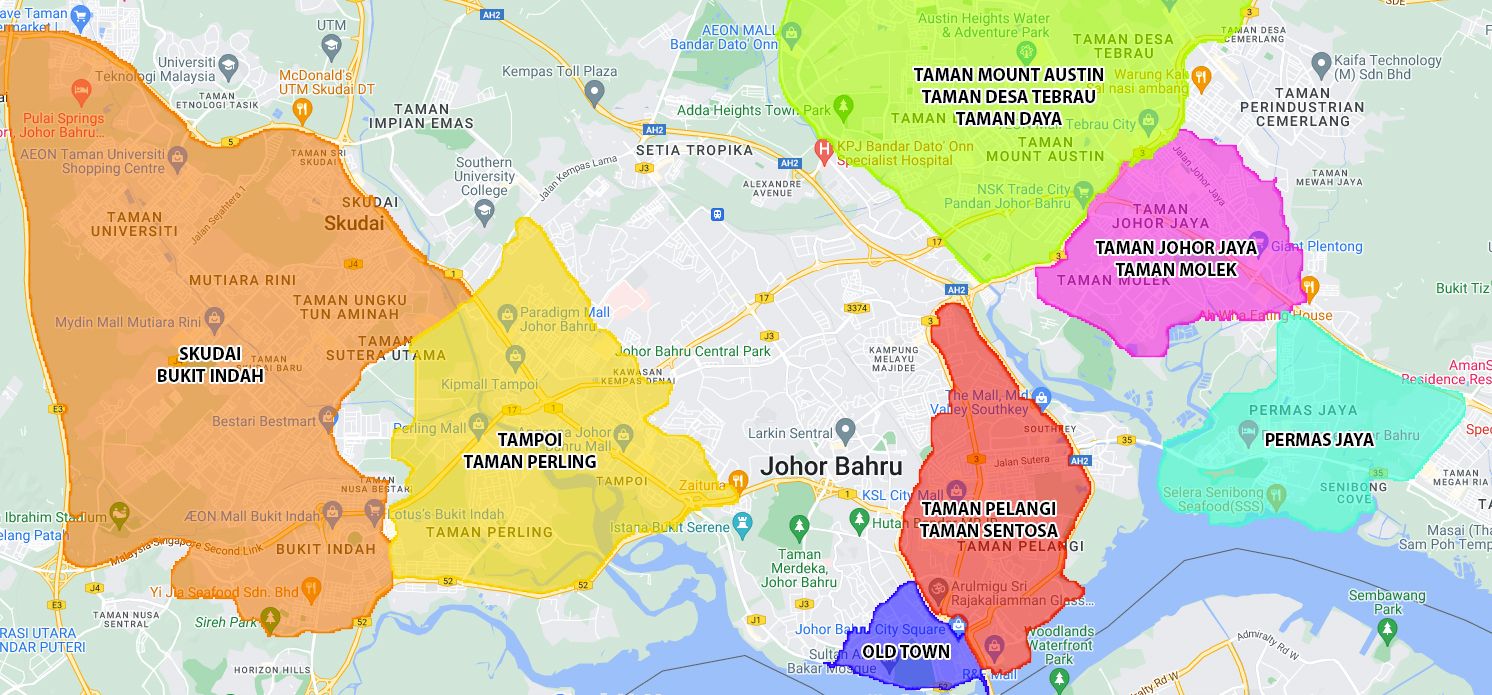

We have divided Johor into 7 areas which we will progressively venture and explore. This is with a view to creating the quintessential guide of Johor Bahru!

The 7 areas are:

- Skudai and Bukit Indah

- Tampoi and Taman Perling

- Taman Mount Austin, Taman Desa Tebrau and Taman Daya

- Taman Johor Jaya and Taman Molek

- Permas Jaya

- Taman Pelangi and Taman Sentosa

- “Old Town” Johor Bahru

Watch out for our guides!

Yours sincerely,

Daryl

For the latest deals and content, join our Telegram channel here today!